Financial institutions that fail to modernize digitally could lose up to 35% of their revenue to digital-first competitors by 2027, says McKinsey & Co.

For CXOs, digital leaders, and product teams, this is a clear call to action: it's time to reimagine how your organization operates, generate revenue, and competes.

That’s why we’ve created this A-to-Z guide to digital transformation in finance sector. We’ll break down the key terms you need to know, explore the current trends and technologies, and examine the challenges holding teams back.

Most importantly, we’ll explore examples from the banking & financial services industry to see how digital transformation is unfolding in practice (offering you actionable solutions that blend technology with human insight).

What’s covered in this blog:

- What is Digital Transformation in the Finance Sector?

- What Technologies Are Shaping Finance Today?

- Examples of Digital Reshaping Finance

- The Key Trends Redefining Financial Services

- Biggest Challenges for Digital Transformation in Finance Industry

- New Rules of Digital Transformation in Finance

- How Bajaj Finance is Powering Digital Transformation with Gyde

- FAQs

What is Digital Transformation in the Finance Sector?

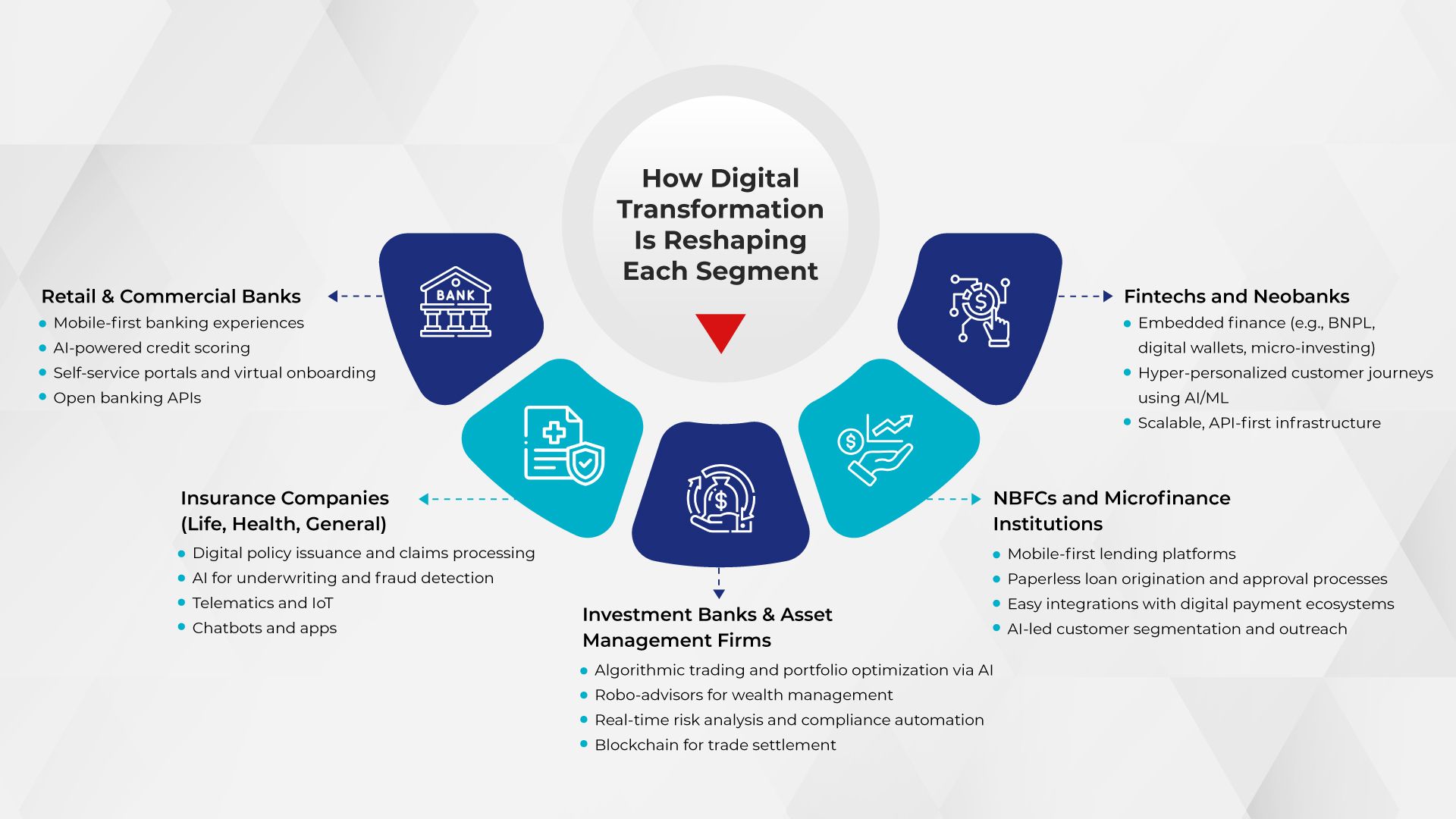

The finance industry includes a broad spectrum of institutions, each serving different customer needs, managing different risks, and facing unique regulatory pressures.

But they all have one thing in common: the urgent need to transform digitally.

The Definition:

Across all segments, digital transformation in finance sector means using technology to drive efficiency, personalization, innovation, and trust, all while staying secure and compliant in an increasingly complex environment.

While each segment has unique needs, you’ll notice recurring themes like mobile-first experiences, chatbots, and AI-driven personalization. That’s because the finance industry often borrows successful ideas across segments.

What Technologies Are Shaping Finance Today?

This section has seven key technologies that are top of mind for financial organizations. We’ll explore what each technology offers and highlight leading organizations providing these innovative solutions.

1. Machine Learning (ML) for Predictive Analytics

Machine learning algorithms analyze vast datasets to identify patterns and predict outcomes, enabling finance leaders to forecast market trends, assess credit risks, and optimize investment strategies. ML helps in decision-making with precise insights that reduce human error and adapt to new data in real-time.

Leading Providers:

- Zest AI: Specializes in ML-powered underwriting platforms that assess borrowers with limited credit history, improving loan approvals while minimizing risks. A financial institution using Zest AI shared that the tool helped increase approvals while tightening risk safeguards.

- Scienaptic AI: Offers an ML-driven credit underwriting platform that integrates non-traditional data, providing predictive intelligence for credit decisions.

2. Natural Language Processing (NLP) for Customer Service Automation

What It Offers: NLP enables AI-powered chatbots and virtual assistants to understand and respond to customer queries in natural language, offering 24/7 support. This technology makes customer interactions faster, provides personalized financial advice, & reduces day-to-day operational costs.

Leading Providers:

- Kasisto (KAI): Develops the KAI conversational AI platform, enhancing client experiences in banking by offering self-service solutions and personalized financial advice.

- IBM (Watsonx Assistant): Powers AI chatbots for financial institutions, improving customer experience with context-aware responses.

3. Generative AI for Financial Reporting and Insights

What It Offers: Generative AI creates detailed financial reports, summaries, and scenarios by analyzing complex datasets. It reduces the time required for report generation, improves accuracy, and supports strategic decision-making by simulating market conditions and forecasting financial outcomes.

Leading Providers:

- Temenos: Uses its patented eXplainable AI (XAI) platform and generative AI to deliver deployment-agnostic solutions. By integrating Temenos and open APIs, PVcomBank decoupled its core systems and their CTO shares the leap they took to cloud-native banking.

- SAP: Offers generative AI tools like SAP Cash Application to automate financial reporting and streamline accounts receivable processes.

4. Deep Learning for Fraud Detection and Cybersecurity

What It Offers: Deep learning models analyze transactional data in real-time to detect anomalies and flag potential fraud or cyberattacks. This technology backs security by identifying complex patterns that traditional systems might miss, ensuring robust protection for sensitive financial data.

Leading Providers:

- Vectra AI: Provides advanced cybersecurity solutions that detect network threats early, integrating with existing systems to enhance fraud prevention.

- Darktrace: Delivers anomaly detection and autonomous investigations, protecting financial institutions from cyber threats with over 200 patents.

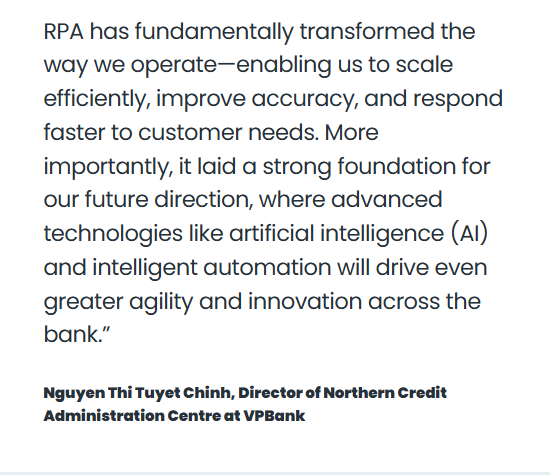

5. Robotic Process Automation (RPA) for Process Optimization

What It Offers: RPA automates repetitive, rule-based tasks such as account reconciliation, invoice processing, and compliance reporting. By reducing manual labor, RPA boosts operational efficiency, minimizes errors, and allows finance teams to focus on strategic initiatives.

Leading Providers:

- UiPath: It simplifies repetitive financial tasks like document review, freeing up resources for strategic projects and innovation. By adopting UiPath RPA, VPBank built the operational muscle needed for smarter automation and long-term digital agility.

- Stampli: Uses AI-driven RPA to automate accounts payable processes, offering audit trails and predictive insights for invoice management.

6. Blockchain with AI for Secure Transactions

What It Offers: Combining AI with blockchain enables secure, transparent transaction processing and data management. AI models executed on blockchain can optimize payments, stock trades, and dispute resolution, ensuring traceability and compliance while reducing costs.

Leading Providers:

- Wealthblock.AI: A SaaS platform that uses AI and blockchain for investor management and capital raising.

- IBM: Integrates AI with hybrid cloud & blockchain solutions for fraud detection & secure financial transactions for institutions like HSBC.

7. Computer Vision for Document Processing

What It Offers: Computer vision automates the extraction and analysis of data from financial documents like bank statements, invoices, and tax forms. This technology accelerates processes like KYC (Know Your Customer) and loan eligibility assessments, improving accuracy and compliance.

Leading Providers:

- Arya.ai: Provides AI APIs for document fraud detection and intelligent document processing for banks and insurers.

- Ocrolus: Combines computer vision with human verification to analyze financial documents. At American Federal Mortgage, Ocrolus brought in AI automation that fast-tracked underwriting by instantly organizing files, saving time.

Examples of Digital Reshaping Finance

Here’s how leading financial institutions and enterprises are embracing digital transformation and reshaping finance:

1. JPMorgan Chase (AI & Automation for Contract Review)

JPMorgan Chase (one of the largest financial institution) turned to digital technologies such as AI, ML and NLP to solve a challenge: reviewing thousands of complex legal documents.

They developed a proprietary AI system called COiN (Contract Intelligence) to review legal documents, specifically loan agreements. Their tech blog says, “COiN can review 12,000 documents in seconds, something that used to take weeks.”

Impact:

- Reduced errors,

- Accelerated contract processing,

- Freed up legal and finance teams

2. DBS Bank (Full Digital Core with Real-Time Insights)

Singapore-based DBS drove transformation by launching 33 platforms mapped to business lines and products. Each was led by two people (a business lead and an IT lead) making sure the strategy and execution stayed connected.

Alongside this, DBS progressed with its cloud migration, embraced automation, and introduced microservices for a flexible architecture where outdated components could be replaced without disruption.

Impact:

- Faster customer onboarding

- Shorter ATM wait times

- Stronger business-IT alignment

3. Mastercard (Blockchain in Cross-Border Transactions)

Mastercard partnered with blockchain firm R3 in 2019 to pilot a cross-border payments solution built on the Corda platform to simplify global B2B payment infrastructures.

The solution was also strengthened by Mastercard’s acquisition of Transfast, a global payments company, helping scale the reach of its blockchain-based network. R3 brought its blockchain expertise, while Mastercard used its brand, distribution, and payment system capabilities to drive innovation and standardization.

Impact:

- Lower transaction processing costs

- Improved liquidity management

- Seamless connectivity across payment systems

- Progress toward global payment standardization

4. Siemens (Finance Shared Services & Automation)

Siemens GBS China adopted automation across its finance, HR, supply chain, & procurement operations. Robots were deployed to take over repetitive tasks like processing orders, verifying data/reports, & managing bank transactions.

With automation running 24/7, tasks previously handled manually were now performed with speed, accuracy, and minimal human intervention. This hybrid workforce model, with bots working overnight and staff picking up in the morning, maximized productivity across departments.

Impact:

- Thousands of work hours saved annually

- Faster, more accurate transaction processing

- Standardized material and financial data management

- Higher service quality with fewer manual errors

5. PayPal (AI/ML for Fraud Detection)

To help businesses operate with security in mind, PayPal embedded AI-powered risk management tools directly into its payment ecosystem. By using real-time fraud detection and its vast global transaction data, PayPal protects merchants from evolving threats without requiring advanced risk expertise.

PayPal’s suite includes Seller Protection, Chargeback Protection, and Fraud Detection, making sure both PayPal and card transactions are monitored, evaluated, and backed by protection programs.

Impact:

- Reduced chargeback fees and fraud-related losses

- Improved order approval rates and fewer false declines

- Fraud detection powered by 15+ billion annual transactions

Bottom line: These examples reflect one clear truth: any financial organization embracing digital transformation should start with a clear goal in mind. It’s not about adopting technology for the sake of it, but about driving tangible impact. Namesake implementation leads nowhere.

The Key Trends Redefining Financial Services

Financial services aren’t just adopting tech; they’re becoming tech.

And this shift isn’t subtle.

It’s platform-led, borderless, and increasingly decentralized.

Here are some trends to look out for:

Trend 1: On-the-fly payments are going mainstream.

India’s UPI and the US’s FedNow are making instant payments not just possible but expected. In 2023, just under one-fifth of all electronic payments globally were real-time, and by 2028, it will be more than one-quarter. This changes everything from how payroll is run to how customers pay bills or get refunds.

Trend 2: Embedded finance is one of the biggest forces reshaping the market.

Instead of redirecting customers to banks, companies like Shopify and Uber are now offering payments, loans, and insurance right within their apps. This embedded approach is expected to unlock a $230B market by 2025.

Open banking (its API-powered sibling) is seeing similar traction, with adoption growing at over 60% annually. What this means for incumbents: you either become part of someone else’s ecosystem or build your own.

Trend 3: Decentralized finance (DeFi) is no longer unconventional

With tokenized assets, yield-generating smart contracts, and blockchain-native lending models, DeFi is creating an alternative layer of financial infrastructure. And while regulation is still catching up, its influence is already being felt in areas like FX, collateralization, and asset management.

In short, finance is becoming faster, flatter, and more programmable.

Biggest Challenges for Digital Transformation in Finance Industry

While most finance leaders are actively exploring digital solutions, tangible progress is steady. What’s holding teams back are familiar set of recurring challenges that are often underestimated or oversimplified.

Let’s see these roadblocks in detail:

1. Legacy Systems Undermine Agility

Outdated systems (like on-premise ERPs, custom-built tools, and spreadsheet-driven processes) continue to form the backbone of many financial operations. These systems aren’t just slow; they’re deeply embedded in how decisions are made and how teams work.

For example: A finance executive attempting to generate a monthly report must extract data from multiple disconnected sources like Excel files, an aging ERP, a billing system, and cloud platforms. What should be a one-click task turns into a multi-hour effort, slowing responsiveness.

2. Change Management Is Often Overlooked

Adoption is more than just about rolling out new tools; it’s about managing behavior, expectations, and trust. Without proper training, context, and support, employees default to familiar methods, even if they are less efficient.

Consider this: An AI-powered forecasting tool is introduced. It offers speed and predictive accuracy, but the team continues using Excel because they’re unsure how the new model works, & there’s no guidance on how to validate its outputs.

3. Data Volume Doesn’t Guarantee Insight

Finance teams deal with large volumes of data, but much of it is inconsistent, incomplete, or irrelevant. Without a proper data strategy, it becomes difficult to extract actionable insights.

A common scenario: A dashboard tracks multiple metrics, but none align with the organization's core KPIs. Quarterly reports still require manual updates because the automated data is not reliable.

4. Security and Compliance Create Delays

Finance teams must adhere to strict regulatory standards. Introducing new technology involves long security reviews, legal checks, and compliance approvals, which can delay adoption.

The friction point: After selecting a cloud-based invoicing solution, an organization postpones the rollout for months. IT and legal teams raise concerns about data privacy, audit trails, and data residency requirements.

5. Tool Overload Without Enablement

The explosion of fintech solutions often creates more noise than clarity. Without a strategic rollout and skill-building plan, tools stack up and productivity actually drops.

Here's the burnout loop: Within 12 months, a team gets a budgeting app, a compliance platform, and a spend analytics tool. But without proper onboarding, each team member uses a different combination or avoids them altogether.

Organizations that overcome these challenges don’t do it by throwing more tools at the problem. They succeed by aligning technology with business goals, user needs, and measurable outcomes.

New Rules of Digital Transformation in Finance: 4 Mindset Shifts That Matter

Here’s what leaders are starting to do differently:

1/ Stop Ripping Out Cores → Start Layering Smart Tech

Don’t tear down—layer up. Legacy systems don’t have to go overnight. Add low-code layers, APIs, and user-facing improvements that work with what’s already there.

Mandar Sahasrbuddhe, CTO at Kirloskar, shared a great example in the Gydebites Podcast. His team was stuck with legacy modules that only supported 3G/4G, but the world was moving to 5G.

Instead of replacing the entire system, they collaborated with a startup to build custom CPE software. This acted like a Wi-Fi hotspot, converting 5G signals into something the older modules could still work with.

It worked. Seamlessly. And without ripping out a single core.

That’s the mindset to take into 2025: don’t wait for clean slates. Use APIs, low-code platforms, and smart middleware to create bridges between the old and the new. Financial institutions don’t have the luxury of long tech rewrites. What you need is speed with stability. That’s where smart layering wins.

2/ Stop Thinking Features → Start Thinking Journeys

Let’s talk about the employee side. It’s often overlooked, but your internal users (your customer support reps, branch staff, operations teams) are also users of digital transformation.

Here's what feature-first thinking sounds like:

“We launched a new ‘Upload KYC Docs’ button on the dashboard.”

But what happens next? Does the employee know what to upload? Are they guided through verification? Do they get notified? What if something goes wrong?

Here's what journey-first thinking sounds like:

“We redesigned the entire KYC flow from notification, to upload, to real-time feedback, to approval status updates.”

Now you’ve solved a need, not added a widget.

Some practical ways to start shifting this mindset is by:

- Starting by mapping your most important employee journeys. Interview end-users. Watch how they actually move through the software.

- Then, evaluate where guidance, automation, or simplification could reduce effort.

- You don’t have to build everything from scratch. Layering tools like a Digital Adoption Platform can help you prototype better journeys without waiting for major software overhauls.

Digital maturity in banking and financial services doesn’t mean having more tools. It means having smarter, more cohesive ones. It’s time to stop showing off dashboards/features and start showing up for users by designing the journeys they actually need.

3/ Stop Overtraining → Start Supporting in the Flow

When training employees in financial organization, it often entails 40-slide decks, 60-minute trainings, or five different tools to learn “just in case.” In reality what happens is they forget most of it by the time they actually need it.

Learning in the flow of work means meeting people where they are, in formats that suit how they work:

- For marketing teams: Short videos inside their LMS to quickly upskill on campaign tools or CRM analytics.

- For customer success teams: In-app help articles right inside the POS system, so reps don’t need to break rhythm when helping customers.

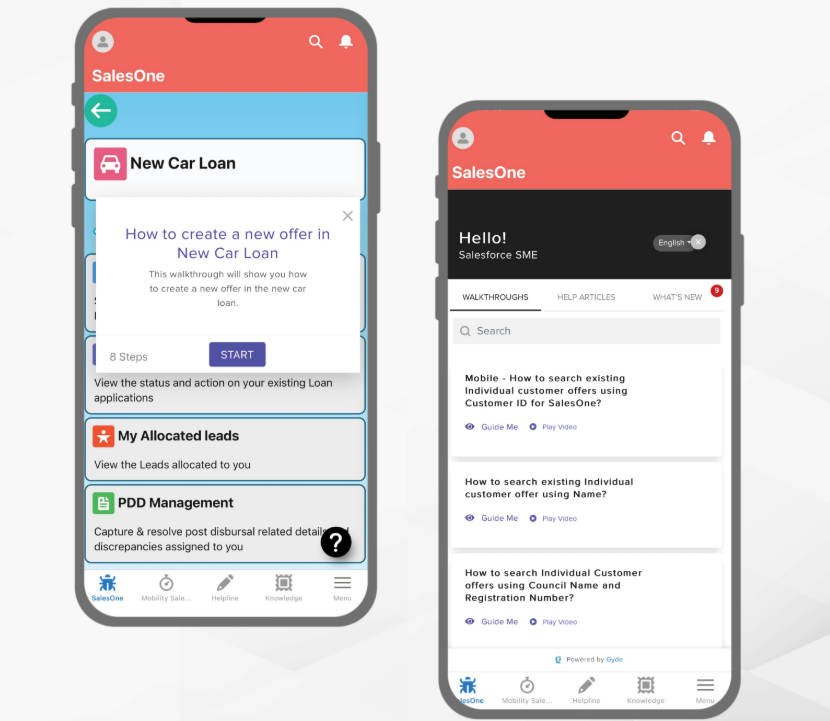

- For field teams: Mobile app walkthroughs that guide them in real-time, so they enter the right data and get more out of the tools they're using.

Each format solves for a different context, but all have one thing in common: they don’t interrupt the work, they blend into it.

Tools like Gyde help embed help right where the user is. Whether it’s Salesforce, SAP, a banking portal, or any internal system—bite-sized walkthroughs, tooltips, and in-app articles pop up exactly when needed.

4/ Stop Focusing Only on Cost-Saving → Start Delivering Delight

It’s easy to fall into the trap of measuring the success of digital transformation through just one lens: cost-saving. After all, ROI reports, budget justifications, and boardroom conversations often revolve around “how much we saved.”

Whether you’re a bank, insurer, or fintech provider, your relationship with customers is built on trust and, increasingly, ease. Customers don’t care how much it cost you to build an app, they remember whether it helped them pay their bills in 2 taps or left them stuck in a loop of authentication errors.

That's why you design customer experience for delight.

Delight is making someone say, “Oh, that was easier than I expected.” Or better, “That just saved me so much time.” These reactions don’t show up on a balance sheet. But they are what drive engagement, retention and growth.

Now try applying this to a claims process in insurance:

- Traditionally, claims journey is a nightmare for customers. It's due to tons of paperwork, opaque updates, long wait times. Many insurers have indeed digitized the forms, which is good.

- But some forward-thinking ones have gone further. Today, we see many provide real-time status tracking, use WhatsApp updates, offer a chatbot that understands emotion (not just keywords), and even offer interim support services while the claim is being processed.

Customers who experience this don’t just finish the process, they remember it. And that’s what keeps them coming back.

Because in 2026, customers and employees alike will expect more than functional. They’ll expect frictionless.

How Bajaj Finance is Powering Digital Transformation with Gyde

Bajaj Finance, one of India's largest and most trusted NBFCs, serves millions across the country with a workforce of over 50,000 employees.

As part of their digital transformation journey, Bajaj Finance didn’t just roll out Salesforce and expect complete software ROI. They saw what many overlook: the confusion of their field agents using Salesforce.

They weren’t filling forms incorrectly out of negligence; they simply didn’t have the right support at the right time. Training manuals weren’t enough. Videos on shared drives weren’t always accessible. The gaps were small, but they showed up every day in the form of delayed loans and stuck files.

That’s where Gyde, an AI-powered DAP gave their agents step-by-step, on-screen guidance on-the-job. They could follow interactive audio-visual walkthroughs, access contextual help articles, or watch videos that were also available for offline viewing. With mobile access for field agents and support in multiple languages, help was always available exactly when and how they needed it.

Bajaj Finance’s training admins were able to create their own process walkthroughs using Gyde’s no-code builder. The built-in GenAI also made it easier, automatically generating step titles and descriptions as they performed the task within the software.

The impact?

Loan file holds dropped from 18% to 9.7% in just three months. That’s no surface-level change. That’s process friction being stripped away, at scale.

For a company handling high volumes and complex workflows, this shift meant fewer mistakes, faster service, and ultimately more satisfied customers.

Here's a takeaway for you:

Digital transformation in financial services doesn’t happen just because you invest in the best tech. It happens when both employees and customers know how to use it confidently, correctly, and every single time.

FAQs

Q1: What are the top trends in digital finance for 2026 and beyond?

- AI-driven hyper-personalization: Deliver tailored financial products and services using artificial intelligence.

- Embedded finance: Integrate financial services directly into non-financial platforms and apps.

- Stablecoins and CBDCs: Adoption of digital currencies backed by stable assets or central banks.

- Generative AI: Automating reporting, insights, and financial decision-making.

- Neobanks: Digital-only banking platforms gaining popularity.

- Blockchain and DeFi: Decentralized finance solutions improving transparency and efficiency.

- Enhanced cybersecurity: Protecting digital finance platforms from evolving threats.

- ESG integration: Aligning finance with environmental, social, and governance priorities.

- Digital wallets: Growth in mobile wallets and contactless payments.

Q2: What KPIs should finance teams track during transformation?

Finance teams should monitor metrics that reflect both financial performance and the success of transformation initiatives:

- Revenue growth: Measure increases in top-line performance.

- Cost reduction: Track savings from process improvements and technology adoption.

- Cash flow: Ensure liquidity and operational stability.

- EBITDA margin: Monitor profitability trends.

- Working capital efficiency: Optimize the use of short-term assets and liabilities.

- ROI on transformation initiatives: Evaluate returns on new technology and process changes.

Q3: What’s the best way to train finance teams for new technologies?

Effective training strategies include:

- Hands-on workshops: Interactive sessions for practical experience.

- Online courses: Flexible learning for theory and best practices.

- Product walkthroughs and tutorials: Step-by-step guides from vendors or internal teams.

- Software how-to videos and contextual help articles: On-demand support during workflow.

- Mentorship programs: Pairing learners with experienced colleagues.

- Ongoing support & sandbox practice: Continuous learning with safe practice environments to build proficiency.