NBFCs are transitioning digitally to eliminate friction across their customer and operational journeys.

Earlier, we saw:

Customers had to stand in long queues just to apply for a loan or pay an EMI.

Employees had to juggle paper-heavy processes and face slow approvals.

But today:

A smartphone and internet connection are all it takes for customers to access financial services in minutes.

AI, automation, and smarter onboarding are helping employees be productive in their roles, which in turn is helping their NBFC stand out.

This shift is no accident. It’s the result of focused digital transformation.

India has over 9,300 registered NBFCs, each striving to digitize operations — from reimagining customer journeys and upskilling their workforce to phasing out outdated processes.

These efforts aim to better serve underserved low- to mid-income segments and unlock scalable, sustainable growth, ultimately contributing to the country’s broader economic progress.

Whether you’re a CXO, a transformation head, or part of the L&D or IT team in an NBFC, this blog brings together real challenges, emerging trends, and practical examples surrounding digital transformation in Indian NBFCs.

For NBFC teams leading change, here’s what you’ll get from this blog:

- What digital transformation really means for Indian NBFCs today

- How different types of Indian NBFCs are approaching digital transformation

- Real examples of digital initiatives from the ground up

- The tangible benefits that go beyond automation

- Key technologies powering each phase of the NBFC loan journey

- The hidden challenges no one talks about (but everyone faces)

- Proven strategies to build a future-ready NBFC

- How can NBFCs differentiate from Fintechs

- The three NBFCs case studies on quietly leading the digital revolution

- How NBFCs can maximize software ROI with a Digital Adoption Platform

What is Digital Transformation in Indian NBFCs?

For Indian NBFCs, digital transformation means moving from paper-heavy, manual processes to AI-driven, data-rich platforms that support:

- financial inclusion,

- faster lending,

- regional language support, and

- seamless customer experiences

...all while managing Indian regulatory complexities and operational scale.

How is Digital Transformation Impacting Each Type of NBFC?

Up next, you’ll find an overview of the different types of NBFCs in India — what they do, and how each approaches digital transformation.

While we’ve outlined these types for context, the real takeaway is this: transformation isn't one-size-fits-all. Each NBFC’s strategy depends on its purpose.

For example, AFCs which provide loans for vehicles or equipment, may focus on enabling mobile-based repayment systems to make collections more efficient. On the other hand, LCs that offer personal or business loans might prioritize automating customer onboarding that speeds up application & approval processes.

All NBFCs start somewhere and by understanding how others are navigating change, you can uncover ideas and solutions that fit your own journey.

Examples of Digital Transformation in Indian NBFCs

Let’s look at some of the ways NBFCs are putting digital transformation into action:

- E-KYC: Electronic Know Your Customer (e-KYC) uses Aadhaar-based authentication to verify identities digitally. NBFCs leverage APIs and OCR tech to reduce onboarding time from days to minutes, especially for underserved customers in remote areas.

- Voice Biometrics: Voice biometrics uses AI to verify a customer’s identity through their unique voice patterns. Some NBFCs are adopting it for secure, hands-free authentication in call centers and mobile apps, enhancing both security and user convenience.

- AI credit scoring: This uses machine learning models to evaluate creditworthiness based on alternative data, such as mobile usage, social signals, and payment history. Indian NBFCs use it to offer loans to first-time borrowers who lack formal credit scores.

- Digital Wallets: Digital wallets enable users to store money and make payments via mobile apps. NBFCs integrate wallet features to offer quick disbursements, EMI payments, and microloans, eliminating the need for physical branches.

- UPI Payments: Unified Payments Interface (UPI) enables instant peer-to-peer and merchant payments. NBFCs use UPI for real-time loan disbursement and repayment collections, especially for gig workers and MSMEs.

- DeFi integrations: Decentralized finance (DeFi) uses blockchain to offer transparent, peer-to-peer financial services. While still emerging, some progressive NBFCs are exploring DeFi for tokenized lending and transparent asset tracking.

- Robo-advisors: These are AI-driven platforms that provide automated financial advice and investment management. Indian NBFCs offering wealth products are integrating robo-advisors to serve mass-affluent customers with low-cost, digital-first solutions.

With these examples in mind, it’s easier to picture the real-world outcomes of going digital. Let’s now look at the core benefits NBFCs can expect when they implement the right technologies for the right use cases.

Benefits of Digital Transformation in Indian NBFCs

When implemented with the right strategy and customer fit, digital transformation can deliver meaningful improvements across the board. Here are some of the key benefits NBFCs in India are already experiencing:

1. Less Manual Work, More Smart Automation

Tools like e-KYC, DigiLocker, and UPI integrations reduce paperwork, eliminate repetitive tasks, and simplify operational processes such as loan approvals and repayments. As a result, your team spends less time verifying documents and more time building relationships that actually drive business growth.

2. Personalized Journeys at Scale

Access to real-time data and intelligent workflows means you can move beyond one-size-fits-all services. Whether it’s sending a timely EMI reminder or recommending a loan based on customer behavior, you can make every touchpoint more relevant—and more impactful.

3. Built-In Security and Compliance

Voice biometrics, digital signatures, and audit trails make security and compliance part of the process, not an extra layer. You stay ahead of regulations, reduce risk, and boost customer confidence without slowing anything down.

4. Scalability Without the Strain

As NBFCs expand their reach across diverse markets, digital tools like cloud-based platforms, API integrations, and centralized dashboards make it easy to onboard new customers, launch products, or enter new geographies without needing to double your headcount or reinvent internal processes.

While these are three of the biggest wins, here are a few more worth calling out:

- Faster onboarding with simplified, mobile-first customer journeys

- Smarter decisions powered by real-time data and analytics

- Greater trust through secure, transparent processes

- Stronger brand perception as a forward-thinking, digital-first lender

Key Technologies Powering Each Phase of the NBFC Loan Journey

If you’re mapping out a digital transformation roadmap in Indian NBFC sector (whether as a CIO, product head, or training lead) this section helps you see what technologies fit where, based on your digital maturity.

1. Customer Acquisition & Onboarding

First Impressions Matter

This is where borrowers first meet your brand. Whether you're dealing with salaried professionals or self-employed individuals, digital tools can simplify and speed up onboarding.

- Digitally Basic: CRM tools like Salesforce CRM or Oracle help track leads and follow-ups. e-KYC and Aadhaar verification tools such as eliminate the need for physical paperwork.

- Digitally Evolving: Mobile apps and portals built using Flutter or React offer borrowers self-serve onboarding. E-signature and e-stamping tools make the process frictionless.

- Digitally Advanced: Some NBFCs now integrate voice/face biometrics for secure remote verification. AI can also pre-qualify customers using historical behavior patterns.

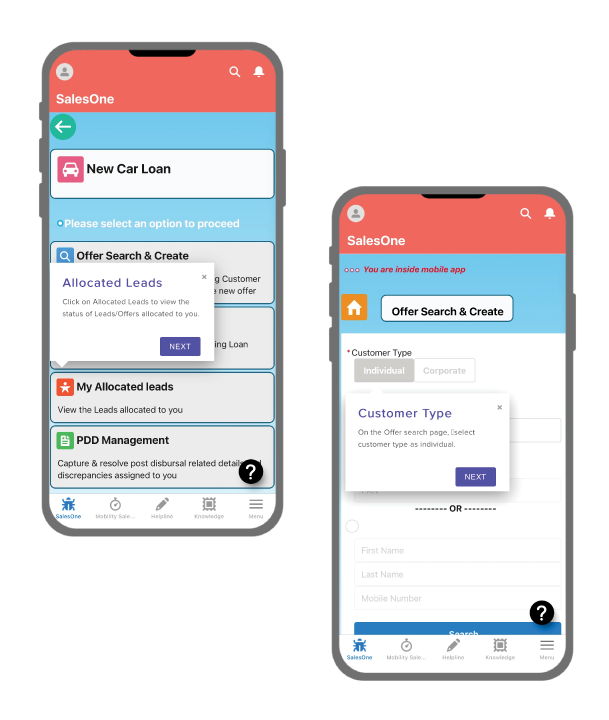

Note: As NBFCs adopt these tools, employees often struggle with unfamiliar interfaces or inconsistent usage. A Digital Adoption Platforms (DAPs) can ease this transition by providing in-app walkthroughs, contextual help, and bite-sized videos, cutting down training time and boosting adoption.

2. Loan Origination

Getting the Application in Motion

Once the customer is in, the next challenge is processing their application quickly and accurately.

- Digitally Basic: A Loan Origination System (LOS) like Finflux or Nelito handles application intake and documentation. Integration with credit bureaus (e.g., CIBIL, Experian) supports basic credit assessment.

- Digitally Evolving: Tools like CreditVidya help NBFCs blend bureau scores with alternative data (like utility bills or social signals) for richer profiling.

- Digitally Advanced: AI-powered credit models predict repayment likelihood or income instability even before human review, improving both speed and accuracy.

3. Underwriting & Disbursement

Making the Decision

This is the heart of lending—and the riskiest part. Technology here reduces manual errors and helps NBFCs scale faster.

- Digitally Basic: Rule-based engines automate basic eligibility checks. Electronic Fund Transfer (EFT) services speed up disbursement.

- Digitally Evolving: Advanced Business Rule Engines allow for complex policy enforcement, while automated underwriting systems bring consistency to decisions.

- Digitally Advanced: AI models can detect fraud in real time. Some NBFCs also use blockchain to create smart contracts that auto-disburse funds based on predefined milestones.

4. Repayment, Collections & Recovery

Sustaining the Relationship

A loan journey doesn’t end at disbursement and it’s only successful when repayment is seamless.

- Digitally Basic: NACH and e-mandates ensure timely EMI deductions. A Core Lending Platform (like OpenCBS) tracks payments.

- Digitally Evolving: Collection management software uses predictive analytics to flag at-risk accounts early. Real-time dashboards (built with Power BI or Tableau) help teams monitor NPAs and collection trends.

- Digitally Advanced: Hyper-personalization tools send targeted reminders, offers, or nudges to improve repayment behavior. AI can even auto-schedule follow-ups based on borrower intent signals.

Bottomline: Digital transformation in NBFCs means using the right tools at the right time in your lenders/borrower's journey. And no matter where you are today, the key is alignment — between your tools, your teams, and the outcomes you want to achieve.

So if you're leading transformation at an NBFC, ask yourself: Where are we on the digital maturity curve? And what’s holding us back from moving forward?

Challenges of Digital Transformation in Indian NBFCs

For L&D leaders, operational heads, and digital transformation teams at NBFCs, adopting new technology isn't just about tools, it's about people. While the promise of digital transformation is compelling, the path to get there is full of hurdles.

Here are some of the most common challenges NBFCs face:

1. Legacy Tech Holding NBFCs Back

Many NBFCs still rely on outdated, disconnected systems that were not designed for scale or real-time integration. Introducing modern tech into these environments often creates friction, forcing costly customizations or complete overhauls that delay transformation efforts.

2. Struggle to Attract Top Tech Talent

Skilled professionals in AI, data engineering, cybersecurity, and CX design are in high demand, often drawn to tech-first companies with more competitive compensation and flexible work cultures. Plus, NBFC sector’s reputation for being risk-averse and process-heavy can also make it less appealing for attracting talent.

3. High Turnover Cost of Digital Frustration

Employees who feel overwhelmed by complex software or unsupported (lack of training) during digital transitions are more likely resist change, feel undervalued, & eventually leave for roles where they feel better supported in their roles. This creates a costly cycle of hiring & training — straining already stretched teams.

(read more: How to Improve Field Sales Training in Indian NBFCs)

4. Growing Cybersecurity Concerns

As NBFCs digitize customer data, launch mobile platforms, and integrate with APIs, they expand their risk surface. Without robust cybersecurity and data governance frameworks, even a small breach can damage trust, trigger regulatory scrutiny, and stall digital adoption.

5. Staying Compliant in an Ever-Evolving Landscape

Every new digital feature or customer touchpoint introduces complexity in compliance. NBFCs often need to abide by new norms around data privacy, digital lending, and e-KYC. This adds layers of compliance that can be hard to keep up with, creating operational bottlenecks and potential risks.

6. Data Abundance, Insight Scarcity in NBFCs

NBFCs generate massive volumes of data from multiple channels, but many lack the necessary infrastructure or expertise to analyze it in real-time. Most times, it's siloed (not centralized). This limits their ability to personalize offerings, predict defaults, or make agile business decisions.

7. Fintech Partnerships Are Easier Said Than Done

While partnering with fintech can speed up innovation, aligning on culture, priorities, and tech architecture is challenging. Poorly integrated collaborations can result in customer confusion, data silos, or increased risk exposure.

(read more: How can NBFCs differentiate from Fintechs)

The good news? You don’t need to tackle these challenges alone. Whether it’s employee training, digital process adoption, or customer-facing flows, there are tools designed to guide the way. More on that in a bit.

Strategies of a Successful Digital-First NBFC

1/ Prioritize Digital Adoption from the Start

Introducing tools like CRMs and Core Banking Systems (CBS) is just one part of your digital transformation. It’s a whole other world to make sure your teams, especially those in the field, know how to use them.

Field agents are your front line. If they can't navigate your systems, product knowledge, data quality, and service delivery all suffer.

Manual training methods or static PDFs are no longer enough in fast-moving, customer-facing roles. Poor adoption leads to slow onboarding, inconsistent service, and flawed data—all of which directly impact business outcomes.

So, you can take help of AI-powered digital adoption tools (for instance, Gyde) that can integrate with your existing systems to provide:

- In-app walkthroughs with on-screen callouts that guide users through each step in the workflow

- Contextual help articles that act as an internal knowledge base, reducing IT support queries and reliance on employee memory or separate manuals

- On-the-job microlearning through bite-sized videos that empowers field agents to pick up processes on the go

Summing Up: Organizations that embed digital adoption early experience faster onboarding, fewer errors, and better data capture, all of which are essential for NBFCs making loan approval/disbursement decisions.

2/ Son of the Soil Strategy

Mittal Dalal, Nation Head of Call Centre at U GRO Capital, says,

“NBFCs have penetrated India, but they are yet to explore Bharat”.

This clearly means that NBFCs need a 'son-of-the-soil' approach for customers in tier 2, 3, & 4 cities to adopt digital lending.

- Digital transformation starts with your people. Hiring from within the community and equipping local teams with multi-lingual support tools can dramatically boost employee productivity & performance within the digital systems.

A Strategic Side Note: Gyde help frontline staff easily navigate systems in their preferred language, allowing them to input correct data & support customers consistently.

- Create services that speak the customer’s needs. Beyond language, this means designing digital user experiences, loan terms, and repayment structures that reflect local aspirations and constraints.

- Use data to tailor products. As digital payments grow in rural areas, NBFCs can tap into behavioral data to create offerings that meet local needs, such as seasonal loans, flexible EMIs, or overdraft options.

3/ Rethink Infrastructure

- Overhauling legacy systems can be costly, not just in terms of a hefty upfront investment, but also in ongoing development, maintenance, and support fees that can quickly escalate.

- Ready-made digital solutions offer a more cost-effective alternative, typically available through subscription-based or pay-per-use models, so NBFCs only pay for what they need.

- Whether it's a customer-facing mobile app, an AI-powered DAP, or an automated loan processing system, these solutions can be deployed quickly, making service offerings better without long delays.

- Many ready-made solutions are designed with regulatory compliance in mind. Pre-configured with features to meet data security, Know Your Customer (KYC) protocols, anti-money laundering (AML) measures, and other regulations, they make it easier for NBFCs to stay compliant without having to start from scratch.

4/ Be Ready for Resistance to Change

- Organizational change is a critical (yet often underestimated) component of successful technology adoption. NBFCs must manage it proactively.

- Set clear goals, milestones, and performance metrics to track progress and stay aligned with broader business objectives.

- Strengthen leadership involvement by appointing board members to actively support and oversee tech initiatives. You can also establish a risk management committee to spot and mitigate tech-related risks early.

- Communicate transparently about the why behind digital initiatives. Address employee concerns head-on and offer the support they need during transitions. This is at the heart of human-centered digital transformation—an approach that balances technological ambition with empathy and clarity.

Sidenote: If you're curious about how such people-first strategies can amplify the impact of data-driven transformation and lead to tangible business outcomes, this Gydebites podcast is a must-listen.

5/ Stay Updated with Government Regulations

If you're running a Middle or Upper Layer NBFC, you're likely already navigating the pressure of the RBI’s Core Financial Services Solution (CFSS) mandate. And if you’re in the Lower Layer, voluntary adoption is being encouraged as a smart way to boost operational efficiency before it becomes mandatory.

Here’s what’s expected:

- 70% CFSS implementation by September 30, 2024 (which is already passed)

- 100% compliance by September 30, 2025

But compliance isn’t just about meeting deadlines. The RBI has intensified its supervision through both on-site and off-site monitoring. Several NBFCs have already faced penalties and restrictions on their product offerings for failing to meet guidelines.

To avoid being in that position:

- Start embedding a compliance-first approach into your digital transformation plans

- Stay updated on areas under scrutiny, such as outsourcing policies, the Fair Practices Code, and KYC Master Directions

- Explore digital tools that simplify compliance tracking and make reporting seamless

Treat compliance as a living part of your process, not a one-time task. That mindset shift can protect your credibility and keep your momentum intact.

How Can NBFCs Differentiate from Fintechs?

Traditional NBFCs have a clear advantage. They come with years of experience, deep regulatory knowledge, and well-established operational frameworks. These strengths have built a foundation of trust and reliability for them.

However, in today’s fast-paced, hyper-digital world, these advantages alone are not enough. The market is evolving rapidly. And that's where FinTechs come in. They bring agility, speed, and a fresh approach to innovation, using personalized, tech-driven solutions.

Many NBFCs are turning to collaboration with Fintechs as a strategic differentiator. They are:

- Adopting FinTech solutions to digitize credit scoring, simplify claims, or offer investment advisory services.

- Partnering on innovation initiatives like co-creating digital lending platforms or testing AI-based risk assessment tools.

- Leveraging referral networks, where an NBFC redirects customers outside its risk appetite to a trusted FinTech partner.

- Launching joint ventures that combine legacy customer trust with next-gen digital experiences.

These alliances allow NBFCs to expand reach, boost efficiency, and modernize offerings without heavy tech overhauls or recruitment sprees.

But such partnerships demands a delicate balance.

Understanding these challenges can make a big difference:

- Finding the right FinTech match with aligned values and vision.

- Measuring ROI beyond vanity metrics.

- Navigating data privacy risks and compliance concerns.

- Integrating two distinct cultures and workflows.

- Accepting that many such partnerships are non-exclusive by nature.

Remember: The NBFCs that will thrive aren’t the ones trying to “out-FinTech” the FinTechs. They’re playing to their strengths (deep customer relationships, financial discipline, and credibility) while strategically plugging into what they don’t (usually) have: speed, tech agility, and innovation culture.

Three NBFCs Leading the Digital Transformation Wave

Bajaj Finance

If you're in the NBFC space and wondering what real digital transformation looks like, Bajaj Finance is a story worth studying.

- Started early: They kicked off their digital journey in 2008, beginning with cloud adoption.

- Future-focused: Today, they’re building toward an AI-first vision (called FINAI) with a clear goal set for 2025.

Here’s how that vision is shaping up:

- Assets under management have grown from ₹2,478 Cr to over ₹3.3 lakh Cr.

- 90% of computing is now on the cloud.

- Their mobile app has been downloaded 61 million+ times.

- 300+ GenAI projects already live, with ₹150 Cr in projected annual savings.

Bajaj Finance understands that digital transformation is:

- Customer-facing. Their recent tie-up with Bharti Airtel aims to create one of India’s largest digital financial platforms. This collaboration helps scale quickly and serve new customer segments.

- Employee-facing. In their lending operations, Bajaj rolled out Gyde, a DAP. Platforms like Salesforce are now easier for teams to use. Onboarding time was reduced dramatically. Less data errors that got less pending loan files, leading to 50% increase in loan approvals, all in just three months.

The Takeaway: For any NBFC leader looking to modernize without losing grip on operations, Bajaj Finance offers a clear message: digital transformation works when it's done with purpose.

L&T Finance Holdings Limited

If you’re an NBFC leader wondering what practical, profitable digital transformation looks like, L&T Finance might just be your case study.

In 2017, while many were debating the merits of cloud versus on-prem, L&T Finance moved fast. They migrated 14,500 employees from outdated mail systems to Google Workspace, giving teams tools like Gmail, Docs, and Meet.

Project Cyclops started in mid‑2024.

- This was an AI experiment focused on integrating machine learning into their two-wheeler loan underwriting.

- They rolled out this initiative across 25 locations with more than 200 dealers.

- They used behavioral and socioeconomic data to supplement traditional credit scores, helping with more accurate approvals and faster turnarounds.

Meanwhile, their loan officers in rural areas could use a Firebase-powered mobile app, employees could work offline, tap into 15+ live data sources, and verify via Aadhaar on the spot. As a result, they saw instant loan decisions and real-time disbursements.

The Takeaway: For L&T Finance, it’s not about jumping on every trend. They have a deliberate, stepwise transformation: Tech that empowers the field sales force, AI that delivers business value, and infrastructure designed to serve every corner of India.

Aavas Financiers

If you’re beginning your NBFC’s digital transformation, Aavas Financiers is a name you’ll want to take notes from.

Started with intent: Their digital transformation began under Project GATI, with a sharp focus on becoming a digital-first, tech-driven, and agile NBFC.

Here’s how that’s translating into action:

- Integrated Account Aggregator to enable real-time bank statement extraction from 23 banks.

- Piloted a multilingual, ChatGPT-powered GenAI chatbot within their customer app.

- Full-scale rollout of digital platforms for loan origination (LOS) and servicing (UNNATI).

- Core systems migrated to Salesforce, Oracle Flexcube, and Oracle Fusion.

- Over 1 lakh loan applications processed digitally, with more than ₹4,500 Cr sanctioned through Salesforce.

To make software adoption easy for tools like Salesforce, Aavas brought in Gyde, an AI-powered DAP. Here’s what Gyde did at Aavas:

- It provided their new FOS agents with in-app guidance in the form of audio-visual walkthroughs, contextual how-to guides, and short videos.

- All of these resources were available in Hindi, Marathi, Telugu, Punjabi, Kannada, and Bengali to give their teams multilingual support.

- New FOS agents can now learn loan processes without interrupting others, easily covering tasks such as lead creation, loan generation, balance transfers, and top-ups.

- Assist Mode also made a big difference. It provides targeted guidance only where needed, so experienced FOS agents users stay focused, avoid distractions, and get work done faster.

The Takeaway: Aavas shows that going digital is investing equally in tech and in the people who use it.

How NBFCs Can Maximize Software ROI with a Digital Adoption Platform

Many NBFCs invest heavily in software but struggle to see the full ROI because employees aren’t fully equipped to use these tools. This gap leads to data errors, high support ticket volumes, and operational inefficiencies.

With the right support system, like a Digital Adoption Platform (DAP), everyone across the NBFC ecosystem can quickly become proficient with new software.

As shown in the Bajaj and Aavas case studies, platforms like Gyde can:

- Help field agents reduce data entry errors,

- Enable branch managers to simplify approvals,

- Assist support teams to resolve customer queries quickly, and

Plus, your NBFC field agents can access Gyde’s support (walkthroughs, help articles or videos) on mobile devices, enabling just-in-time guidance.

For training creators, creating training content is easy with their no-code walkthrough creator. The built-in AI automatically generates step titles and descriptions, which saves you hours of work. You can also turn your walkthrough into videos, help articles, step-by-step guides, or translate it into any language with just one click.

Its powerful analytics tracks how users interact with the content. See where they drop off, which steps take the most time, and how effectively your content is helping them complete tasks. This helps you continuously improve your training.

In short: If you’re an Indian NBFC looking to go digital, start by making sure your teams can actually use the tools you invest in. With platforms like Gyde, those software proficiency “AHA!” moments come a lot faster.

FAQs

What are emerging technology trends in 2025 for Indian NBFCs undergoing digital transformation?

In 2025, Indian NBFCs are adopting technologies like:

- AI-powered In-app training and onboarding.

- Artificial Intelligence for credit management.

- Robotic Process Automation for paperless processing.

- APIs for integrated accounting.

- Advanced analytics for real-time insights and scalability.

- Blockchain for dynamic workflow management.

- Chatbots and NLP for enhancing compliance and fraud control.

What are the key performance indicators (KPIs) for measuring the success of digital transformation in Indian NBFCs?

KPIs include: customer acquisition cost, customer retention rate, loan processing time, operational efficiency (cost-to-income ratio), digital penetration rate, and customer satisfaction scores.

What role does data analytics play in NBFC Digital Transformation?

Data analytics is a critical enabler for NBFCs, driving efficiency, personalization, and risk management. Here’s how:

- Personalized Experiences: Segment customers based on behavior for targeted products and services.

- Risk Management: Use real-time insights to reduce NPAs and detect fraud.

- Operational Efficiency: Automate approvals and reduce processing times.

- Regulatory Compliance: Automate reporting for adherence to guidelines.

- Customer Retention: Identify cross-selling and upselling opportunities.

What strategies can NBFCs employ to enhance customer experience digitally?

To improve digital customer experience:

- Personalize Offerings with AI: Use data and AI to offer tailored loan products and repayment options based on customer behavior.

- Enable Omnichannel Support: Provide a seamless experience across mobile apps, websites, and service centers.

- Deploy 24/7 Chatbots: Automate support using AI chatbots for instant query resolution anytime.

- Launch Self-Service Portals: Let customers apply for loans, track status, and manage accounts independently.

- Offer Multilingual Interfaces: Support regional languages to make services more inclusive and accessible.