What could be a major factor in an Indian NBFC’s success?

The answer is clear—well-trained and dedicated teams of frontline workers (a.k.a. the Feet-on-Street (FOS) agents). These individuals tirelessly reach out to potential customers and make crucial financial services accessible to them.

But let's not forget: Managing large & geographically scattered FOS teams comes with deep-rooted challenges (such as high churn rate, cultural & language differences and limited digital proficiency) that can seriously compromise training effectiveness.

Why Read This Blog?

With our experience in the digital adoption space, we spoke with multiple Indian NBFC leaders (a case study is included towards the end) and discovered challenges and suggestive strategies to establish a strong training and support system for FOS agents.

What to Expect in This Blog?

- What is the Field Sales Force in NBFC?

- Importance of Field Sales Force in Indian NBFCs

- Challenges(+Solutions) in Indian NBFC’s FOS Training

- 4 Tips to Develop Application Training For FOS Agents

- Case Study: Bajaj Finance - Pioneering NBFC in Field Sales Force Training

What is the Field Sales Force in NBFC?

The NBFC field sales force, or "feet on the street" (FOS), are the individuals on the ground who directly connect with customers to offer NBFC products.

By understanding customer needs, these FOS agents offer customized financial solutions, and drive these institutions' growth and success.

Initially, FOS agents relied solely on traditional methods like cold-calling and door-to-door selling. But as times have changed, they need to embrace technological advancements to better serve their customers.

In simple terms – the NBFC field sales force acts as the bridge between the institution and its customers.

Importance of Field Sales Force in Indian NBFCs

What FOS teams bring to the table is:

- Acquiring new customers by directly engaging with them, explaining financial products, and convincing them to purchase.

- Reaching underserved markets where traditional banking services are lacking and offering tailored financial solutions.

- Building personal connections and gaining trust through face-to-face interactions leads to repeat business and referrals.

- Gathering valuable market insights, including trends, preferences, and competitor strategies, helps adaptation and competitiveness.

- Creating a feedback loop on customer satisfaction, product performance, and market demand, enabling refinement and innovation.

- Representing the brand's values and professionalism, enhancing reputation and credibility through excellent service and positive relationships.

Now, let's talk about what hinders the training of the field sales force at NBFCs.

Challenges(+Solutions) in Indian NBFC’s FOS Training

Unlike other industries, Indian NBFCs face a unique challenge in digitally transforming their FOS teams. While digitalization offers immense potential in the form of increased employee efficiency, improved customer service, and reaching a wider customer base, it requires overcoming hurdles, such as:

1. Data Inaccuracy and Application Navigation

- Indian NBFCs often rely on off-roll training for their field sales force (FOS). This means teams can access technological platforms like CRM, HRMS, or payroll systems without in-depth training.

- While these platforms offer features to track performance, understand customer interactions, and calculate incentives, their complex interfaces can be challenging for FOS to navigate.

- For instance, when registering a new customer for a home loan, precise details are crucial for further loan processing. Mistakes or omissions can significantly delay the entire process.

In essence, the lack of proper training on navigating these platforms leads to data inaccuracy and reduced efficiency for NBFC field sales teams.

[Be sure to check out our four tips below as they delve deeper into application training for Indian NBFC’s FOS agents.]

2. Balancing Training with Busy Schedules

- Training becomes a logistical challenge as field sales agents (FOS) often juggle many tasks.

- Typically, FOS teams have to manage field visits, take follow-ups, negotiate deals, and maintain digital tools, so there is little time to invest in traditional methods such as printed training manuals or e-learning modules.

- This results in poor knowledge retention and overburdened agents, which is why many leaders struggle with when and how to deliver critical knowledge to their FOS teams.

What might help? To bridge the gap between theory and practice and allow FOS agents to learn flexibly within their tight schedules, use time-efficient training methods such as providing training materials just in time (on mobile devices).

3. NBFC’s High Scalability Creates Onboarding Hurdles

- The expansion of NBFCs demands a continuous increase in product offerings and often requires recruiting new sales professionals.

- To succeed in this sector, new hires must understand the fundamentals of the product features and benefits, including government regulations.

- Traditional training approaches can take weeks, if not months, causing delays in onboarding and disrupting sales momentum, thus posing a substantial challenge to growth.

Here’s an approach you could take: Design onboarding programs that focus on the individual’s ability to learn with agility. Post hiring, you can use onboarding methods such as gamification and blended learning to cultivate flexibility, curiosity, and the ability to quickly adapt to new challenges and be well-prepared to contribute effectively from day one.

4. Insufficient NBFC Product & Service Knowledge

- Filling new positions is just one hurdle while scaling an NBFC. Another critical challenge is the knowledge & skill gap within your existing field sales force.

- Each product or service brings unique selling points, technical specifications, and potential customer objections. If your teams cannot articulate these nuances, it can negatively impact the customer experience.

- Imagine them as grounded airplanes—full of potential but unable to take off due to outdated product knowledge. At times, they may falter in recalling their training, leaving them unprepared during customer interactions.

There’s no quick fix. But … you can implement periodic training sessions to keep the sales team updated with the latest product developments. You could also create a centralized knowledge base where all product information, FAQs, and training materials are stored.

5. High Turnover in NBFC Sales Teams

- Some NBFCs have high-pressure environments alongside poor communication, which leads to high turnover rates.

- As a result, training becomes reactive, focusing on equipping new hires with the bare minimum to function rather than building on their potential.

- Further contributing to the issue – employees feel unmotivated and undervalued when their career paths are unclear, and promotions are slow, potentially contributing to the churn the company hopes to avoid.

Solution? Try having realistic sales targets. Conduct regular one-on-one meetings between managers and team members to discuss concerns and career aspirations. Plus, consider conducting exit interviews to know why employees are leaving and use it as feedback to identify pain points and work on them.

6. Bridging the Language Divide

- India's diversity of languages is a strength, but it can present a unique hurdle in the NBFC training landscape.

- It is crucial for success that all team members grasp complex financial concepts and product nuances regardless of their native tongue.

- However, traditional, monolingual training can leave some employees feeling left behind. This leads to uneven performance, knowledge gaps, and potential customer service issues.

What’s the silver bullet here? Develop training modules, presentations, and reference guides in multiple languages your workforce speaks. Choose technology platforms that support & translate existing and new training material into multiple languages.

7. Overcoming "But This Is How We've Always Done It"

- Change, even when positive, can be met with resistance.

- Embracing new training can be unsettling for your frontline workers. Most times, experienced salespeople might worry that new techniques will disrupt their rhythm or render their current skills obsolete.

- This resistance to adopting new training programs can create a significant roadblock to maximizing your team's potential.

How do we flip this situation? By taking an approach that doesn’t force change but creates a supportive environment, try including feedback mechanisms and involving the team in shaping the training program – fostering a sense of ownership and increasing buy-in.

8. Staying Compliant with Government Regulations

- The ever-evolving regulatory landscape can be a daunting challenge for NBFCs in India. The Reserve Bank of India (RBI) continually updates regulations tailored to the size and type of NBFC – making it a difficult task for FOS teams to train and adhere to diverse sets of rules.

- For example, KYC(Know-your-customer) norms are a must-follow for NBFCs. This means verification processes evolve, requiring continuous training for FOS agents on the latest formalities.

- Failing to stay informed about these changes proactively may heighten the risk of penalties and reputational damage associated with non-compliance.

As a remedy, it’s of utmost importance for NBFC leaders to subscribe to official press releases and updates from regulatory bodies like the RBI(Reserve Bank of India) and FSLRC(Financial Sector Legislative Reforms Commission). Also, establish internal forums for employees to share knowledge, ask questions, and stay updated.

If these challenges sound familiar, you've likely encountered difficulties with application adoption as well. To help, we've outlined four tips to digitize application training specifically for FOS agents.

4 Tips To Digitize Application Training for Indian NBFC Field Sales Teams

1. Create Relevant Instructional Content

Creating relevant instructional content for NBFC's Field Sales Force (FOS) agents requires pinpointing the specific roles and challenges your FOS agents face. What knowledge gaps do they have? What are the common customer queries they encounter?

To make training engaging, use various formats such as screenshots, videos, and infographics instead of traditional paper manuals. You could also use simple instructional design software that can create and distribute training content easily.

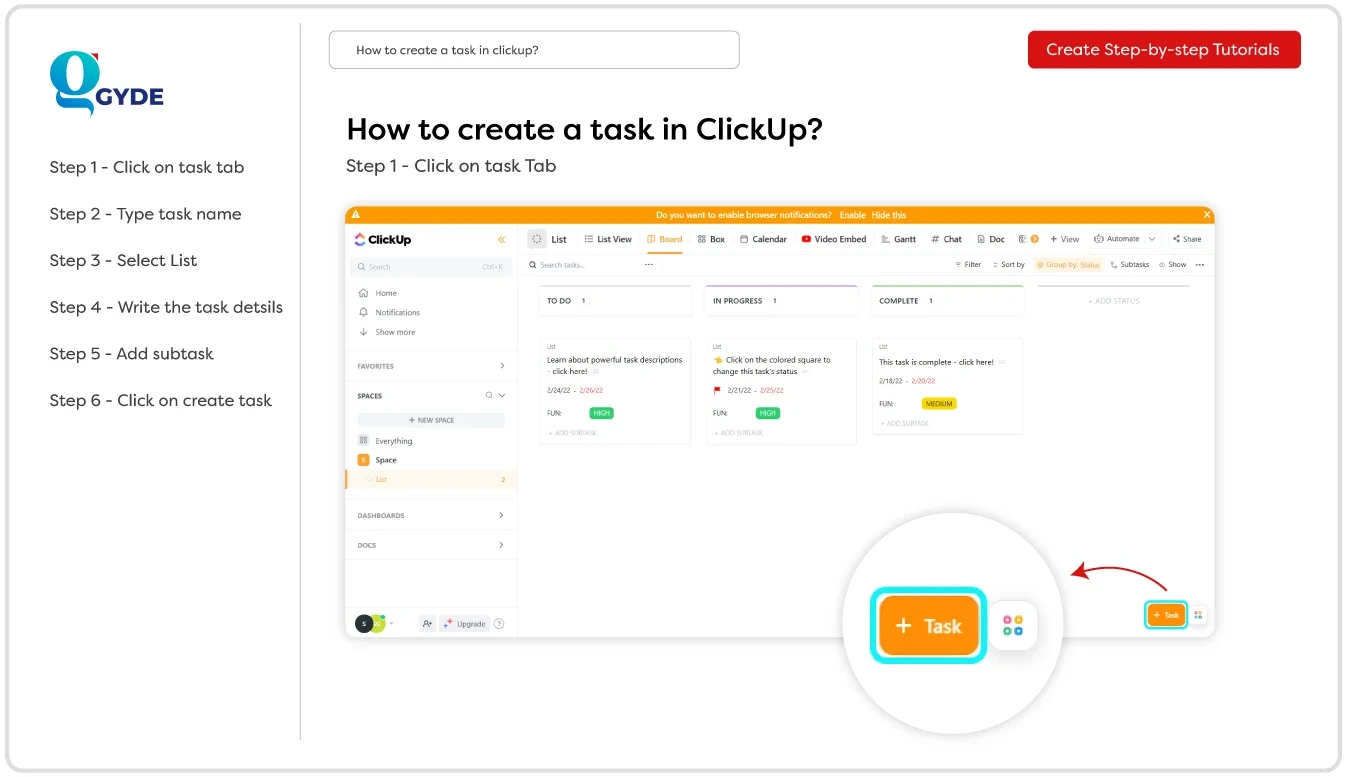

Platforms like Gyde AI documentation let you capture workflows with simple clicks and annotate screenshots.(It also offers video guide creation) These guides can be easily created and shared via a link. Here's an example of a guide for creating a task in ClickUp.

You can easily create and share similar guides with your NBFC field sales force for quick reference. For instance, training administrators can map the loan processing workflow, create digital checklists for each stage to ensure that agents do not miss critical steps.

Plus, you could also explore and use tech platforms that have features like pre-filled common fields. Having this feature can minimize agent errors and speed the approval process, thereby improving customer experience and trust.

2. Start Smart & Self-Serve Software Training

In Indian NBFCs, sales teams heavily rely on POS and CRM systems. Often, the training provided on these applications is monotonous. So, it’s advised to offer easy application training right from the start and maintain consistent support thereafter.

Fortunately, new tech tools, such as digital adoption platforms can help. Here's how:

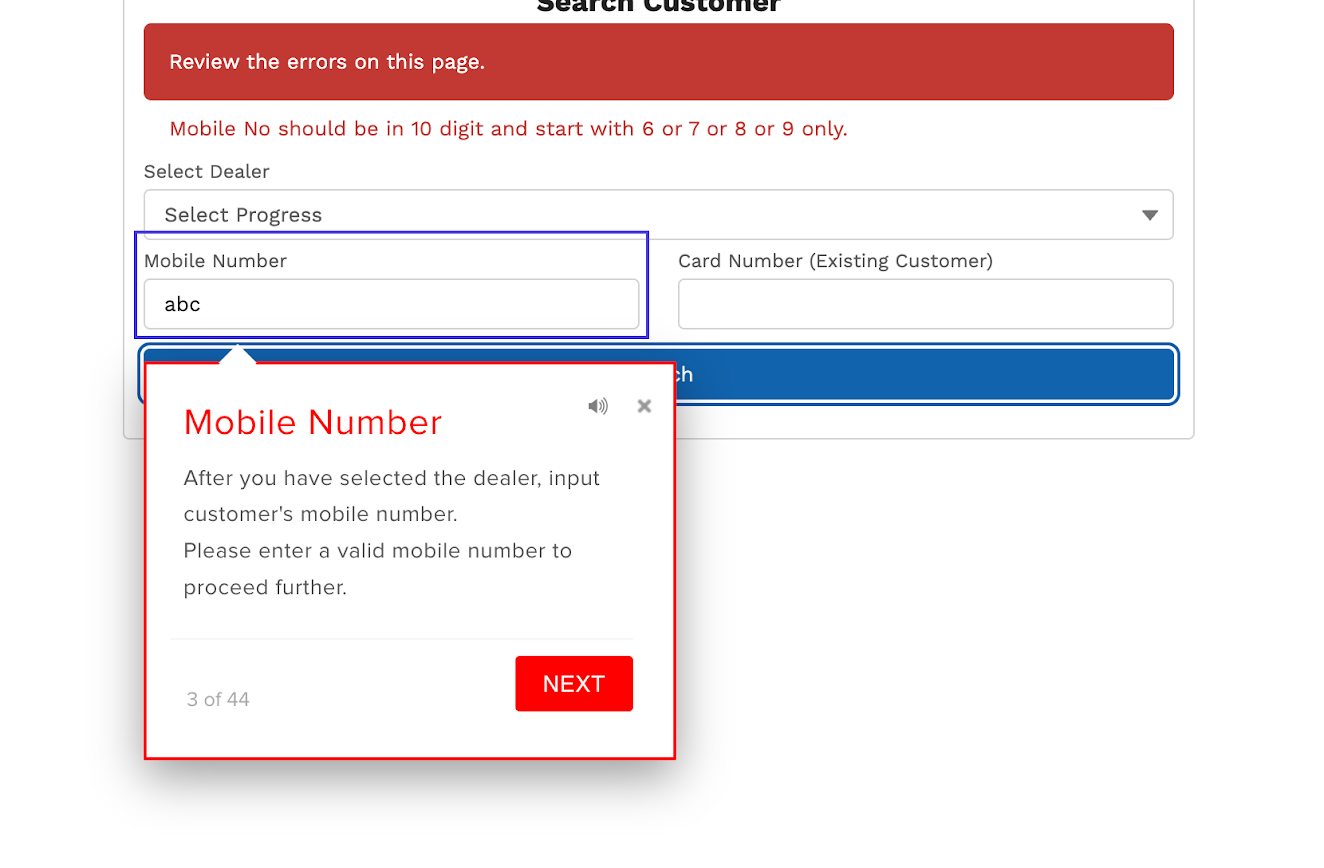

- Learn While Working: Sales reps get help within the apps they use daily (POS, CRM), minimizing flow disruption and helping them recall.

- Self-Sufficient Sales Team: In-app resources like walkthroughs and FAQ articles empower reps to solve problems independently.

Bottomline: For FOS agents, DAPs reinforce existing knowledge, fill gaps, and help learn about new application features. Using its no-code & AI-powered interface simplifies the creation, updating, and reuse of training materials for training creators.

Using a DAP, field sales force agents can learn new processes by following a checklist.

3. Give Personalized Help for Diverse Roles

Traditional sales training often falls short for NBFC teams because it fails to acknowledge the different needs of various roles.

Think about it: New recruits need onboarding, experienced reps require skill development, and leaders need coaching strategies. Thus, you should cater training programs to address these specific knowledge gaps.

Other than this, sales reps, underwriting specialists, and relationship managers all use different applications with unique features. Training materials should be relevant to each user's role and permissions within the application.

When choosing training software, prioritize its ability to deliver a personalized experience. If you already have training software in place, consider integrating it with other systems like CRMs or performance support tools. This will make sure field agents receive real-time, customized training resources, which enables knowledge retention and drives improved sales performance.

4. Track Training Impact

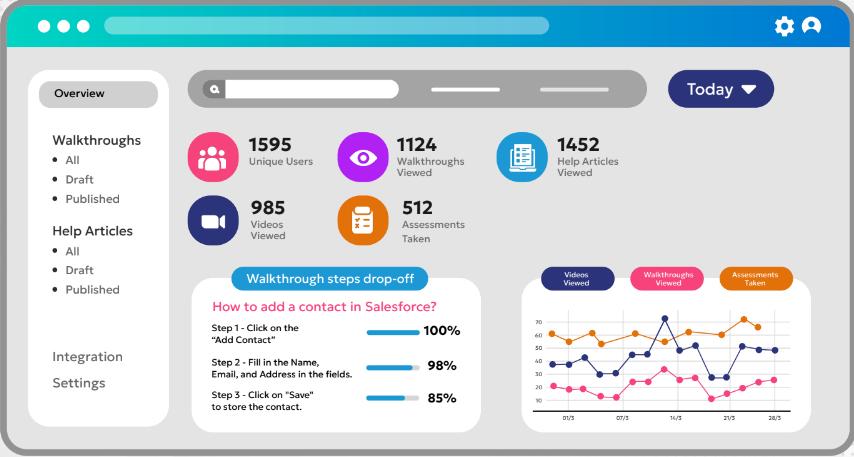

To optimize FOS agent performance and knowledge retention, it's advised to monitor their proficiency in using tools like CRMs and sales enablement platforms.

By implementing comprehensive training programs on these platforms and using analytics, organizations can gain insights into agent behavior and identify areas for improvement.

For instance, if you’re using an Learning Management Systems (LMS) to create training on more complex topics, such as compliance training. Their analytics give you a breakdown of who has finished the training, passed it, or not completed it yet.

On the other hand, within DAPs, which offer walkthroughs and help articles, you can track user engagement to understand how well the training is received. You'll see who accessed the training, when they accessed it, where they dropped off, and many more such analytical insights.

Bonus Tip:

- Incentivize Participation: Recognize and reward employees who actively participate in training and demonstrate improved skills. This reinforces the value of learning and motivates continual development.

Case Study: Bajaj Finance - Pioneering NBFC in Field Sales Force Training

Let’s see how Bajaj Finance Ltd to make their field sales force training better.

Brief Overview of a Prominent Indian NBFC

Bajaj Finance Ltd. has over 50,000 employees and serves a diverse clientele of 72.98 million customers in urban and rural regions of India.

With a widespread presence across rural areas and strategic partnerships with numerous local establishments such as furniture and electronics stores, they extend loans services to customers.

Challenges They Faced

Bajaj Finance invested considerably in Salesforce to simplify its lending process, but they continued to face challenges as their field agents (FOS) weren’t able to use it to its capacity.

Plus, their sales teams were spread all over India. As they were not native English speakers, they were unable to understand the training content. This also meant, they accidentally entered the wrong data or missing information altogether.

As a result, many loan applications kept going on hold, slowing everything down. To top it off, NBFCs have a high turnover rate of field agents. So, basically, they were stuck with a system that could be great, but getting everyone on board was proving difficult.

Search for Solution

Tackling application adoption challenges, Gyde, an AI-powered Digital Adoption Platform(DAP) reshaped Bajaj's application training for their field sales force agents.

Let's see how Gyde helped!

- Gyde helped Bajaj Finance’s employees with in-app walkthroughs and contextual help articles. This meant no more wasting time searching for instructions on a separate tab as they could get guidance right where the FOS agents needed it – within the Salesforce CRM itself.

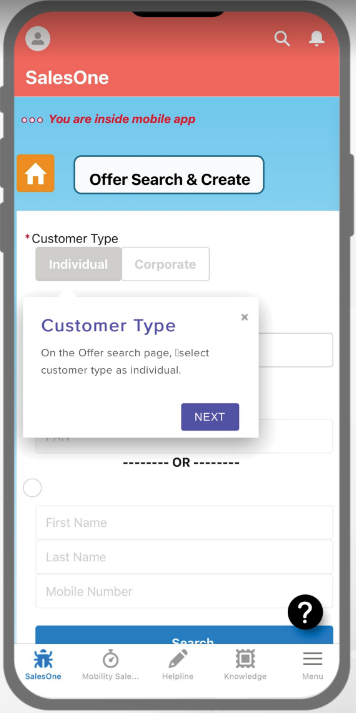

- All the help resources had multilingual capabilities. FOS agents could choose their language of preference and get trained on using Salesforce. This created personalized and impactful training experience for everyone involved.

- The on-the-job training method greatly reduced the time it took for FOS agents to learn their tasks, making it more convenient and efficient, especially in the context of high employee turnover.

- With Gyde, Bajaj enhanced their system's data quality by using field validations to prevent data errors. It provided real-time assistance with error messages that clarified necessary corrections, leading to fewer loan files being placed on hold.

- Auto-assist feature was particularly useful for employees who were already experienced with the application and just need a little guidance for certain steps.

- Besides this, these help resources were optimized for mobile devices, significantly simplifying field force training.

Result?

Remarkably, within three months of implementing Gyde, Bajaj Finance reduced loan file holds from 18% to an impressive 9.7%. This led to decreased training time, increased CRM adoption, and maximized employee productivity and performance.

To sum up, we hope this blog helps you digitally transform the way you train your FOS agents!

FAQs

1. How do NBFCs measure the effectiveness of field sales force training programs, and what key performance indicators (KPIs) do they use to track progress?

NBFCs measure training effectiveness by tracking KPIs such as:

- Sales Performance: Tracks revenue growth post-training.

- Customer Satisfaction: Assesses how well agents meet customer needs.

- Employee Retention: Measures if training improves job satisfaction and reduces turnover.

- Training Completion Rates: Indicates agent engagement and content effectiveness.

2. What future trends or innovations are expected in field sales force training for NBFCs, considering the evolving digital landscape and customer preferences?

Future trends in field sales force training for NBFCs include:

- Increased integration of augmented reality for immersive training experiences

- AI-driven chatbots for on-demand support,

- Predictive analytics for identifying training needs

- Remote training solutions to accommodate distributed workforces.

Are there any best practices from other industries that NBFCs can adapt to improve field sales force training?

Absolutely. NBFCs can learn from industries like retail, telecommunications, and technology, which rely heavily on field sales forces. Here are a few best practices:

- Gamification in Training: Introduce gamification elements like points, badges, and leaderboards to create a sense of achievement, keeping agents engaged and motivated.

- Mentorship Programs: Pair new field sales agents with experienced mentors for hands-on, relevant training that accelerates their learning curve.

- Data-Driven Personalization: Use data analytics to tailor training programs based on the agent’s role and hierarchy, ensuring each individual receives the most relevant and impactful training.